Merger of IDIs

I. The Six-month Rule (12 C.F.R. § 330.4)

When the deposit accounts of one IDI are acquired by another IDI, the newly acquired deposits are separately insured from any accounts a depositor may already have at the acquiring IDI for an initial period of six months. This grace period is intended to give depositors an opportunity to restructure their accounts if the merger causes a depositor to have funds in excess of the insurance limits at the acquiring IDI.

If a depositor only held funds at one of the two IDIs that merged, this grace period would not apply, as the depositor’s insurance coverage would be unaffected by the merger.

The grace period may be applied differently for time and non-time deposits.

II. Time Deposits

CDs acquired by an IDI are separately insured from pre-existing deposit accounts at the IDI, subject to the following rules:

- Time deposits that mature after the six-month grace period remain separately insured until they mature.

- Time deposits that mature within the first six months after the merger and are renewed for the same time period and the same dollar amount as the original deposit (with or without accrued interest added to the principal amount), will continue to be separately insured until the first maturity date after the expiration of the six-month period.

- Time deposits that mature within the first six months after the merger and are renewed for a different dollar amount or a different time period (even if the acquiring IDI does not offer CDs for the original time period), or time deposits that mature within the first six months and are not renewed and thereby become regular savings or demand deposits, are separately insured only until the end of the six-month period.

Example 25

Facts:

Acquiring Bank and Bank Sold merged on July 1, 2010. Before the merger, Michelle Young purchased:

- A $240,000 CD from Acquiring Bank on January 1, 2009. The CD has a four year term, and it matures on January 1, 2013; and

- A $230,000 CD from Bank Sold on October 1, 2009. The CD has a one year term, and it matures on October 1, 2010.

Three months after the merger, on October 1, 2010, Michelle Young renewed her Bank Sold CD for another one-year term until October 1, 2011. Michelle rolled over her original $230,000 principal. Assume accrued interest for both CDs is mailed monthly.

How are these CDs insured?

Rule:

- When two or more IDIs merge, deposits from the assumed IDI (in this example, Bank Sold) are separately insured from deposits at the assuming IDI (in this example, Acquiring Bank) for at least six months after the merger. This grace period gives a depositor the opportunity to restructure his or her accounts, if necessary.

- CDs from the assumed IDI are separately insured until the earliest maturity date after the end of the six-month grace period.

- CDs that mature during the six-month period and are renewed for the same term and in the same dollar amount (either with or without accrued interest) continue to be separately insured until the first maturity date after the six-month period.

- If a CD matures during the six-month grace period and is renewed on any other basis, it would be separately insured only until the end of the six-month grace period.

Answer:

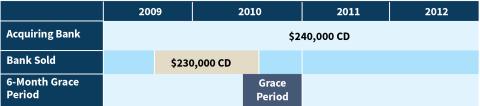

Acquiring Bank and Bank Sold merged on July 1, 2010. Before the merger, Michelle Young purchased a $240,000 CD from Acquiring Bank on January 1, 2009. The CD has a four-year term, and it matures on January 1, 2013. She also purchased a $230,000 CD from Bank Sold on October 1, 2009. The CD has a one-year term, and it matures on October 1, 2010. At the time of the merger, Michelle Young has a $240,000 CD from Acquiring Bank and a $230,000 CD from Bank Sold.

Given that the IDIs merged on July 1, 2010, the initial six-month period extended through December 31, 2010.

By 2010, Michelle Young has a $240,000 CD from Acquiring Bank and a $230,000 CD from Bank Sold.

The IDIs merge on July 1, 2010; the six-month grace period extends to December 31, 2010.

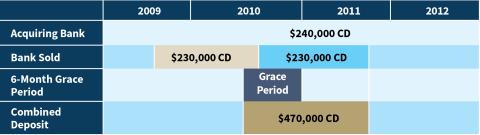

During the grace period, Michelle Young renewed her Bank Sold CD with the same terms so her two CDs continued to be insured separately until her Bank Sold CD matured on October 1, 2011.

As a result, her two deposits totaling $470,000 were fully insured until October 1, 2011.

By 2010, Michelle has a $240,000 CD from Acquiring Bank and a $230,000 CD from Bank Sold. The IDIs merge on July 1, 2010.

The six-month grace period extends to December 31, 2010.

During the grace period, Michelle renewed her Bank Sold CD with the same terms, therefore, her two CDs continued to be insured separately until her Bank Sold CD matured on October 1, 2011.

As a result, her combined deposit of $470,000 is fully insured until October 1, 2011.

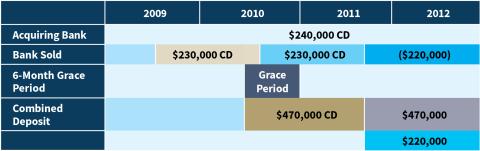

However, after October 1, 2011, a combined deposit of $470,000 would exceed the $250,000 insurance limit by $220,000.

Therefore, Michelle must withdraw at least $220,000 to avoid potentially uninsured funds.

No six-month grace period for depositors that merge

The grace period does not apply to the deposits of two or more business entities that may merge. It also does not apply to the merger or combination of governmental entities. For example, if two corporations merge, and both entities were depositors in the same IDI, those accounts are not treated separately but are immediately aggregated as of the date that the businesses merge.

For More Information from the FDIC

Call Toll-Free

1-877-ASK-FDIC (1-877-275-3342)

Calculate deposit insurance coverage using the FDIC’s Electronic Deposit Insurance Estimator (EDIE)

Read more about FDIC deposit insurance on our Deposit Insurance webpage

View frequently asked questions on deposit insurance coverage

Order FDIC deposit insurance products through the FDIC Online Catalog

Submit deposit insurance questions online using the FDIC Information and Support Center

Submit deposit insurance questions by U.S. Mail

Federal Deposit Insurance Corporation

Attn: Deposit Insurance Unit

550 17th Street, NW

Washington, DC 20429