Systems for measuring and managing interest rate risk (IRR) are key analytical tools for helping banks position themselves for potential changes in interest rates. Using IRR measurement tools effectively, however, requires banks to make reasonable assumptions about how the rates and volumes of its key product lines would change as interest rates change. After six years of historically low interest rates, including notably little volatility in the federal funds rate, developing these key assumptions is both challenging and important.

This article describes the importance of appropriate assumptions for the analysis of IRR. Additionally, the article describes the process to develop some of the key assumptions necessary to evaluate interest rate sensitivity in the current environment. The development of deposit and asset assumptions will be explored in particular as these inputs can have the largest impact on the results of an IRR analysis. As described in this article, it is generally possible for such assumptions to be developed by bank staff.

Importance of Assumptions

An effective risk management framework consistent with outstanding supervisory guidance can help banks position themselves for changes in the interest rate environment. IRR analysis is not intended to dictate how management should react to changes in interest rates, but should be used as a tool to understand how current actions may affect future earnings.

In this respect, a systematic approach to developing common-sense assumptions for use in IRR measurement systems is an important part of a bank’s strategic planning. Conversely, using unrealistic or overly optimistic assumptions in IRR systems can result in an inaccurate picture of a bank’s risk exposure, potentially resulting in flawed asset-liability management strategies.

FDIC examiners review key assumptions as a part of the Sensitivity to Market Risk review at each examination. The use of unsupported or stale assumptions is one of the most common IRR issues identified by FDIC examiners. Common weaknesses found during the review of assumptions are:

- Use of peer averages without consideration of bank-specific factors

- Lack of differentiation between risingand falling-rate scenarios

- Over-simplification of balance sheet categories leading to potentially faulty analysis

- Lack of qualitative adjustment factors to historic data (e.g., not considering a higher run off factor for surge deposits)

Another issue that examiners observe is that some institutions do not attempt to evaluate how the results of their IRR measurements would change in response to a change in assumptions (i.e., sensitivity testing). If results would change significantly in response to change in a critical assumption, prudence suggests planning for a range of values for that assumption.

In certain cases, banks have engaged outside vendors or consultants to formulate assumptions because of a lack of resources. In such cases, management needs to satisfy itself that assumptions reflect the specifics of the institution’s assets and liabilities and local markets, and should not categorically rely on universal assumptions provided by vendors or consultants. FDIC examination reports sometimes cite overreliance on generic vendor-provided assumptions as a weakness in IRR management.

While many banks use consultants to help develop assumptions, it is not a requirement to do so, and most banks can reduce expenses by generating assumptions internally. This article focuses on ways banks can develop and support their assumptions with existing staff. It is important that management employ assumptions, that are based on an evaluation of key characteristics, such as loan prepayment speeds, non-maturity deposit decay rates, surge deposit run off, and the likely extent of deposit re-pricing.

General Considerations for Developing Appropriate Assumptions

Expectations for the development of assumptions used to measure IRR are commensurate with an institution’s complexity and sophistication. A bank with a simple balance sheet employing conservative, commonsense assumptions that are readily understood by senior management and the board of directors will typically not be criticized by the examiners. Conversely, a bank that uses more complex mathematical analyses to support aggressive assumptions may be subject to greater scrutiny.

The IRR measurement process depends heavily on certain critical assumptions to generate reasonably reliable results. At a minimum, management should give particular consideration to non-maturity deposit price sensitivity (or betas)1 and decay rates, the reasonableness of asset prepayment assumptions, and key driver rates for each interest rate shock scenario. Non-maturity deposit assumptions are especially relevant in today’s environment as these deposits represent a historically large volume of bank funding, and customer behavior may not reflect past behavior when market rates change in the future. Furthermore, institutions with significant investments in longer-duration securities should place additional emphasis on developing assumptions for rising-rate scenarios where bond depreciation may pose outsized or unintended risk to earnings and capital.

Generally, key assumptions used in an IRR measurement system should be reviewed at least annually. Management can employ a variety of techniques to develop key assumptions; however, all such techniques involve obtaining and analyzing relevant data, and making judgment-based adjustments to reflect the possibility that assumptions based on past data may not reflect future trends. Generally, the most representative data source for deposit assumptions is the institution’s own historical information. Prepayment assumptions can be sourced from national averages, data vendors, internally generated analyses, or a blend of these approaches.2 Generally, asset prepayment would slow down in a rising-rate scenario, so for purposes of simple and conservative estimates of the effect of rising interest rates it may be sufficient simply to assume only a minimal level of prepayments.

Management should also ensure it measures the IRR of the current balance sheet. Optimistic assumptions about the growth of loans or other income can potentially mask the degree of IRR. Accordingly, banks using growth assumptions as part of their measurement of IRR should also generate “no growth,” or static analysis, to evaluate exposures if no balance sheet growth occurs.

Deposit Assumptions

Deposit assumption development typically addresses two factors:

- Beta Factor, which represents the magnitude of deposit re-pricing for a given market rate change. This assumption is a critical component in income simulations.

- Decay Rate, which relates to the runoff or cash outflow over the life of the non-maturity deposit. Commonly associated with the economic value of equity analysis.

Expectations about customer behavior, specifically non-maturity depositor assumptions, can be the most difficult and challenging to develop. Non-maturity products do not have contractual cash flows or maturity dates and have experienced pronounced growth in the post-crisis low-interest rate environment.

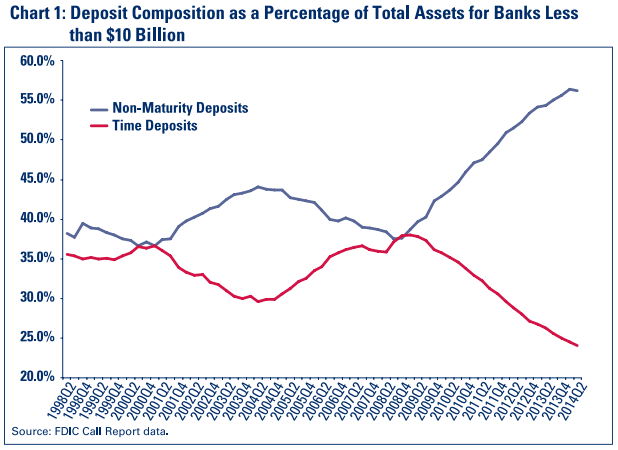

Chart 1 reflects how demand, negotiable order of withdrawal (NOW), money market deposit accounts (MMDA), and other savings accounts have increased during the past several years to represent 56 percent of total assets at institutions with total assets less than $10 billion as of June 30, 2014, up from 38 percent at the end of 2008. The increase is attributable to the minimal rate differential between non-maturity products and term certificates of deposits, bank and non-bank investments, flight to quality spurred by the financial crisis, and depositors’ uncertainty about future interest rates. Consequently, nonmaturity deposit volumes may experience significant declines as “surge deposits,” as they are commonly known, could rapidly migrate in a rising-rate environment to higheryielding deposit products or non-bank investments. Certificates of deposit (CDs) that have migrated to savings or other non-maturity account types in recent years should be included in considering surge deposit fluctuations, as these funds are more likely to migrate back to CDs as rates rise. In a rising-rate environment, the bank’s ability to maintain pricing power over savings accounts may diminish as the traditional CD funds residing in nonmaturity deposits flow back into CDs.

Deposit Beta Assumptions

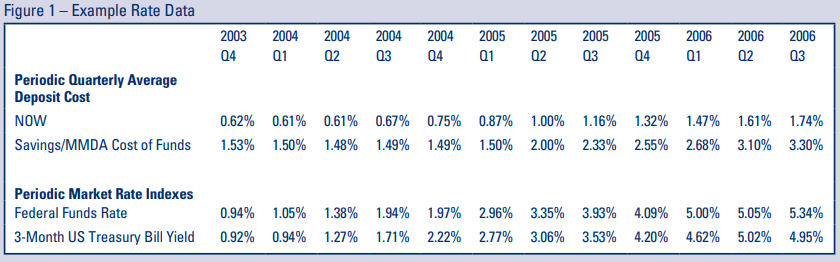

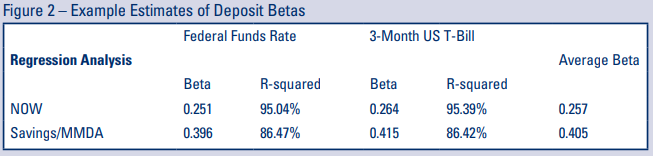

Although there are a range of tools available for estimating deposit betas, community banks’ analyses need not be highly complex to provide sufficient insight on deposit re-pricing tendencies. It also is important for banks to remember that the various assumptions used in an IRR analysis are for analytical purposes and do not constrain the bank’s future flexibility to respond to developments, including competitive pressures, liquidity needs, etc. Simple approaches for estimating beta, weighted average life and decay rate deposit assumptions are discussed below.3 A more involved example of estimating deposit re-pricing betas is presented in the following graphic, “Enhanced Analytics for Estimating Deposit Betas.” This approach is broadly illustrative of the types of analysis some larger institutions and IRR software vendors may undertake when they develop deposit re-pricing assumptions; however, the underlying principles are similar to the following example.

A basic assumption for deposit betas can be obtained by looking at how the bank’s deposit costs changed during a period of changing market interest rates. For example, if a bank’s non-maturity deposit costs increased 40 basis points in response to a 100 basis point increase in market interest rates, this suggests an initial assumed beta of 40 percent, or 40 basis points for each 100 basis point increase in interest rates. Effects on deposit pricing can differ significantly depending on whether interest rates are rising or falling and, as such, banks should consider their deposit pricing experience in both types of environments. For example, in the current low-interest rate environment some banks view their current cost of non-maturity deposits as unlikely to decline further even if the Treasury yield curve were to move downward.

Historical data on deposit pricing provide a starting point and some perspective for developing assumptions, but banks should consider qualitative adjustments to deposit betas to reflect the possibility that surge deposits will be strongly rate-sensitive once interest rates start increasing. For example, assumed deposit betas based on historical re-pricing experience should probably be adjusted upwards for banks that garnered significant volumes of deposits during the low-interest rate environment of the last several years.

Deposit Decay Rate Assumptions

In a rising-interest rate environment, the rates at which deposits run off will directly affect a bank’s cash flows and the effective maturity of its liabilities. Deposit decay rates are, accordingly, critical inputs to a bank’s IRR measurement system. Non-maturity deposit balances do not all “mature” in unison, but decay over time. Typically the non-maturity deposit base is relatively stable with a longer average life characterized by a slow decay; however, the surge of funds into non-maturity deposits in recent years poses a new challenge in determining decay rate assumptions. Given the increased likelihood of surge deposits to experience rapid runoff in a rising-interest rate environment, management could segregate its surge deposits as appropriate from its more stable non-maturity balances.

Although decay rates are always an essential assumption for any IRR measurement system, particularly in the longer-term analysis of economic value of equity, the assumptions related to surge deposit decay may prove to have a larger impact on IRR in a scenario in which market interest rates increase in the near term

The basic methods of estimating decay rates begin similarly to beta assumption development, with the collection or tracking of sufficient deposit data over one or more relevant periods. Most institutions should have the ability to track how balances in their deposit products have changed over time as economic conditions and interest rates have changed. Such information can be used to develop an initial baseline estimate of potential deposit runoff. After the historic decay rate has been calculated, banks should consider adjustments for qualitative factors to reflect current-period market conditions and anticipated customer behavior in response to interest rate fluctuations, for example by adjusting upwards the assumed runoff of surge deposits as discussed above.

Other considerations should also affect assumptions regarding the decay rates of time deposit balances. Banks may assume that time deposits will not re-price until their maturity date because of early withdrawal penalties. Depending on the specifics, however, customers may benefit from incurring the penalty and reinvesting (at the bank or elsewhere) at a higher market rate. The likelihood that this will occur would be greater, the more pronounced is the increase in market interest rates.

Asset Assumptions

In addition to deposit assumptions, expectations related to loan prepayment and re-pricing can have a significant effect on the results of IRR measurement systems. The precise timing of cash flows that determine the value of the assets are uncertain and can fluctuate with market rates, shifting underwriting standards, loan seasoning, and competition. Prepayment estimates are critical as cash flows may be received more quickly or slowly than projected. In a hypothetical rising-rate scenario, loan prepayments may slow significantly and result in an overall extension in the duration of the loan portfolio and mortgage-backed securities investments. Also, rising market rates may curtail refinancing activity and early loan pay-offs, reducing asset re-pricing opportunities. In light of these considerations, for purposes of analyzing the effects of a rising-interest rate scenario, a simple, conservative and defensible approach could be to simply assume only a minimal level of prepayments.

Variable Rate Loans, Caps and Floors

Banks should evaluate the impact changing rates may have on variablerate loans. It is important to consider the impact rate caps or floors may have on the actual re-pricing characteristics of the portfolio as it may improve or exacerbate exposures. For example, if an institution has established contractual rate floors well above prevailing market rates, the impact of rising interest rates will not be immediately reflected in earnings. The gap between the prevailing rates and the contractual rate floor could potentially be several hundred basis points, negating potential improvement in loan yields until substantial increases in index or market rates occur. This delay effectively increases a bank’s liability sensitivity because deposit rates will likely increase while some asset yields remain level. In a rising-rate environment this would adversely impact net interest income.

Investment Portfolio

Bank investment portfolios have recently grown as a percentage of balance sheet assets and, in turn, so has the importance of understanding how market values are influenced by interest rate changes. An understanding of how rate changes may affect the value of current securities holdings, as well as prospective purchases, is essential. Longer-maturity fixedincome securities with the relatively low coupons that have prevailed in recent years are likely to experience significant price depreciation in a rising-interest rate environment. When considering the effects of increasing interest rates, banks should guard against assuming more than a baseline level of prepayments on mortgage-backed securities and typically should not assume that callable bonds they own will be called. Analysis should at a minimum encompass a spectrum of rate-change scenarios to determine the overall portfolio sensitivity and the potential magnitude of depreciation relative to capital. An unanticipated extension of asset cash flows or elevated securities deprecation could adversely affect management’s ability to use investments for liquidity needs or take advantage of profitable reinvestment opportunities.

In response to the inherent risks of investment securities in the rising-rate scenarios, banks should consider incorporating the results of portfolio deprecation analyses into initiatives for future investment portfolio purchases, risk reduction strategies, and liquidity forecasting.

Credit Risk

Although traditionally not a part of IRR analysis, management could consider increased credit risk posed by loan re-pricing opportunities in a rising-rate scenario. If interest rates were to rise, there may be a potential for increased losses related to marginal borrowers as they struggle to meet higher debt service requirements. The lending function could proactively identify credit relationships where borrowers have marginal cash flow for debt service to identify credits that are at higher risk of default if rates increased.

Sensitivity Testing

Assumptions which have the most influence on the results of the IRR system should be identified and analyzed to determine the impact of changes to those assumptions. Generally, results are most sensitive to deposit betas, weighted average life, and decay rates. However, prepayment speeds and asset re-pricing factors also should be evaluated to determine the extent to which they may affect the IRR system’s results.

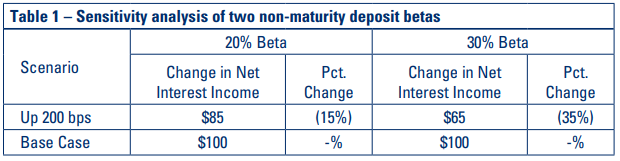

The objective of sensitivity analysis is to isolate the impact a single assumption may have on the results of the IRR measurement system. This is accomplished by changing one assumption (e.g., increasing the decay rate or the beta factor by X percent) and re-running the analysis to compare results. (Table 1 reflects a hypothetical sensitivity analysis of the non-maturity deposit beta assumption comparing the results of a 20 percent beta against that of a 30 percent beta.)

The data in Table 1 reflect that net interest income would decline by significantly more using a 30 percent beta than the 20 percent beta in an up-200 basis point scenario. The example highlights the importance of testing the sensitivity of results to changes in assumptions. In this example, a relatively small and plausible change in assumptions about deposit pricing resulted in a materially more negative picture of the effects of rising interest rates. Varying assumptions in this way can heighten management’s awareness of the potential risks to the institution should assumptions prove overly optimistic, and thereby inform the development of prudent strategies to mitigate risk.

Conclusion

The current economic and interest rate environment presents unique challenges for the IRR analysis process. Although assumption development can appear highly technical, a sharp focus on a few key assumptions can significantly improve the reliability of results and a bank’s understanding of the potential implications of changes in interest rates. Further, the variety of tools and range of sophistication in determining assumptions are scalable to all financial institutions.

The key to effective interest rate risk analysis has been and remains the development of assumptions that reasonably reflect the characteristics of the bank’s assets, liabilities, and off-balance sheet items. Adoption of an appropriate assumption development framework can ensure the effective use of IRR measurement tools to benefit decision making, risk management, and the bank’s overall performance.

Ryan R. Thompson

Financial Institution Examiner

Minneapolis, MN Field Office

Division of Risk Management Supervision

rythompson@fdic.gov

1 In this context “re-pricing betas” refers to how changes in deposit rates compare to driver rates, such as the Fed funds rate.

2 Typically, community banks that collect prepayment estimates from external sources obtain this information from a model vendor or an external vendor.

3 This example is not intended as a prescribed format or methodology for determining deposit assumptions. It illustrates a straightforward approach for determining deposit assumptions. The appropriateness of an individual institution’s methodology should be based on the institution’s structure, products, and complexity.